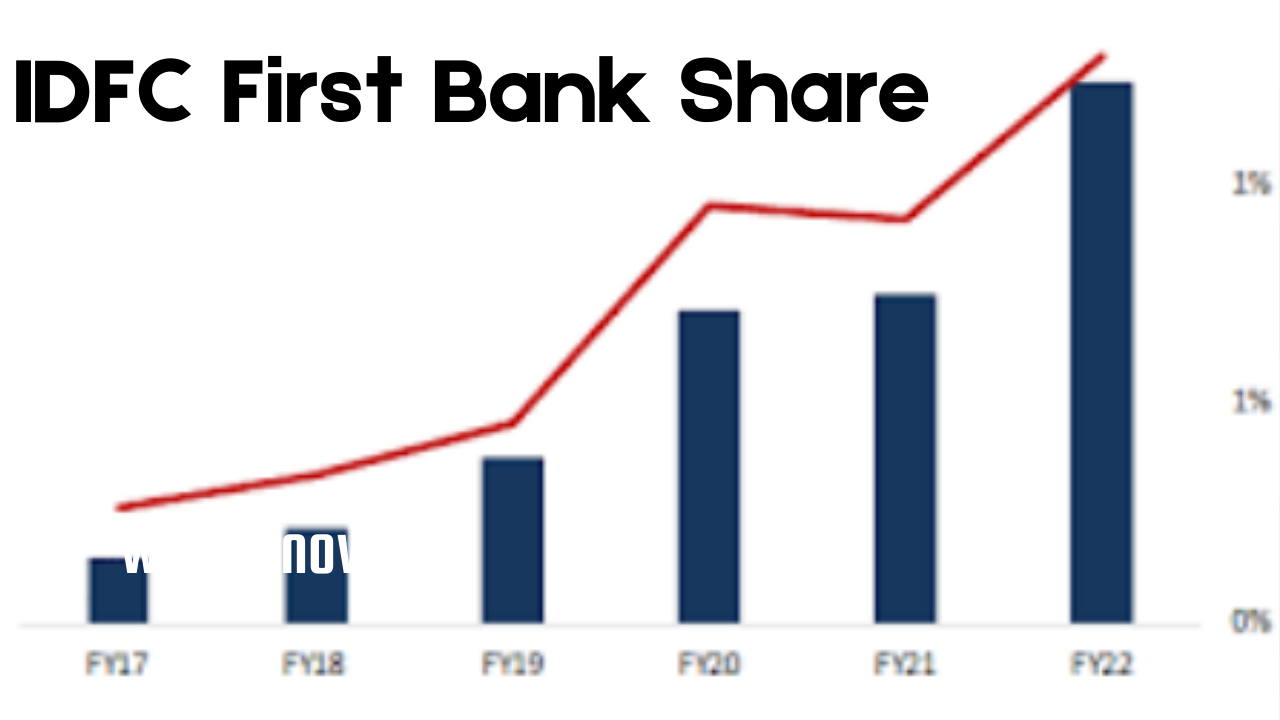

IDFC first bank share is a new-age private bank resulting from the merger of IDFC Bank and Erstwhile Bank. With a focus on retail banking and digital innovation, idfc first bank share has captured investor interest. But what does the future hold for its share price? In this blog post, we’ll delve into analyst expectations and explore potential targets for idfc first bank share from 2024 to 2030.

Factors Influencing Share Price Targets

Before diving into specifics, it’s crucial to understand the factors that influence share price targets:

- Bank’s Financial Performance: This includes factors like profitability, asset quality, loan growth, and net interest margin (NIM). A strong financial performance instills confidence in investors, potentially leading to a higher share price.

- Economic Indicators: The overall health of the economy significantly impacts the banking sector. Factors like GDP growth, inflation, and interest rates play a role in determining loan demand and bank profitability.

- Market Trends: Broader market sentiment and trends in the banking sector can significantly influence idfc first bank share. Positive industry trends and a bullish market can lead to a higher valuation.

- Company-Specific Developments: Mergers and acquisitions, new product launches, and successful execution of growth strategies can positively impact the share price.

idfc first bank share Targets (2024-2030)

It’s important to remember that share price targets are predictions based on various assumptions and can fluctuate. However, by analyzing expert opinions and market trends, we can create a range for potential future prices. Here’s a table summarizing analyst targets for idfc first bank share :

| Year | Target Range (₹) | |

| 2024 | 72 – 118 | |

| 2025 | 96 – 153 | |

| 2026 | 139 – 179 | |

| 2027 | 155 – 215 | |

| 2028 | 174 – 249 | |

| 2030 | 219 – 339 |

drive_spreadsheetExport to Sheets

Key Considerations

While the targets provide a potential roadmap, keep these points in mind:

- Short-term volatility: The stock market is inherently volatile. The actual share price may deviate significantly from the target range in the short term due to unexpected events.

- Long-term potential: The long-term targets (2027-2030) indicate a potentially significant upside, reflecting the bank’s growth potential.

- Do your research: Analyst targets are valuable inputs, but conducting your own research on the bank’s financials, industry trends, and overall economic outlook is crucial before making any investment decisions.

Conclusion

idfc first bank share future share price hinges on various factors. However, analyst targets suggest potential growth in the coming years. By closely monitoring the bank’s performance, economic conditions, and market trends, investors can make informed decisions about idfc first bank share stock. Remember, this information is for informational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor before making investment decisions.